Sss Philippines Contribution Table 2025

Sss Philippines Contribution Table 2025. This is the maximum cap of your salary, if it's more than this, your contribution will just be based on this maximum range. You can find the pension factor in the sss table of pension factors, which is available on the sss website or at any sss office.

Sss building east avenue, diliman quezon city, philippines. This is the maximum cap of your salary, if it’s more than this, your contribution will just be based on this maximum range.

Historically, the sss set deadlines for contributions based on the last digit of the employer’s or individual member’s sss number.

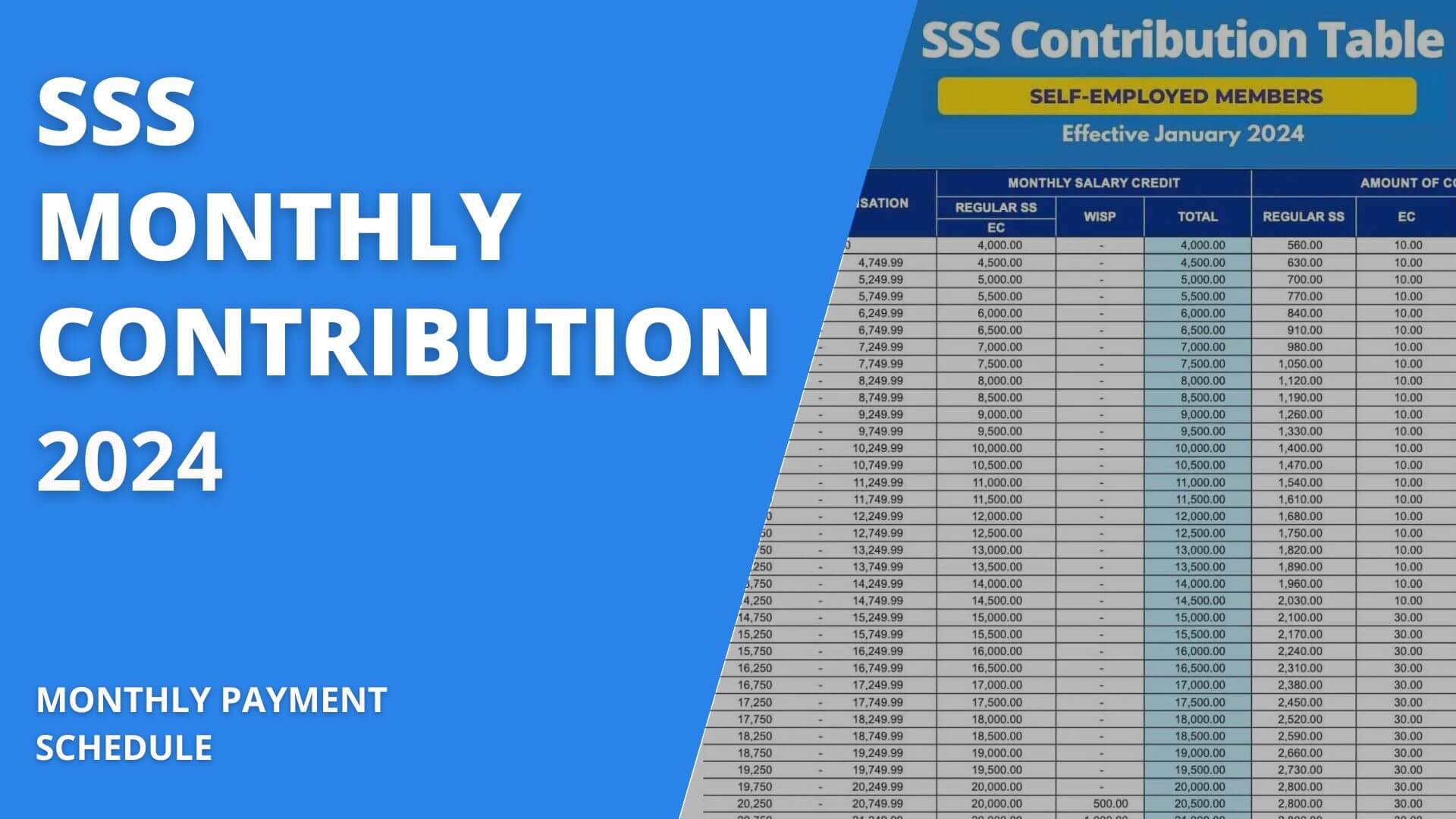

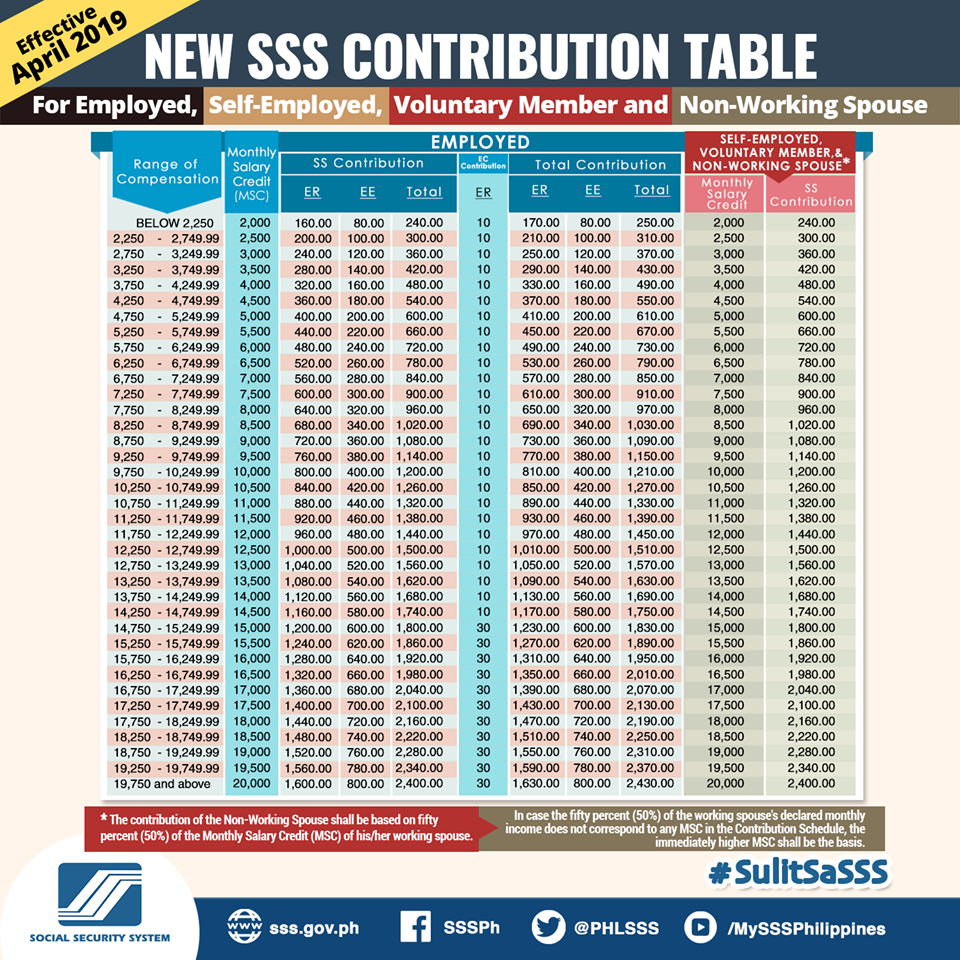

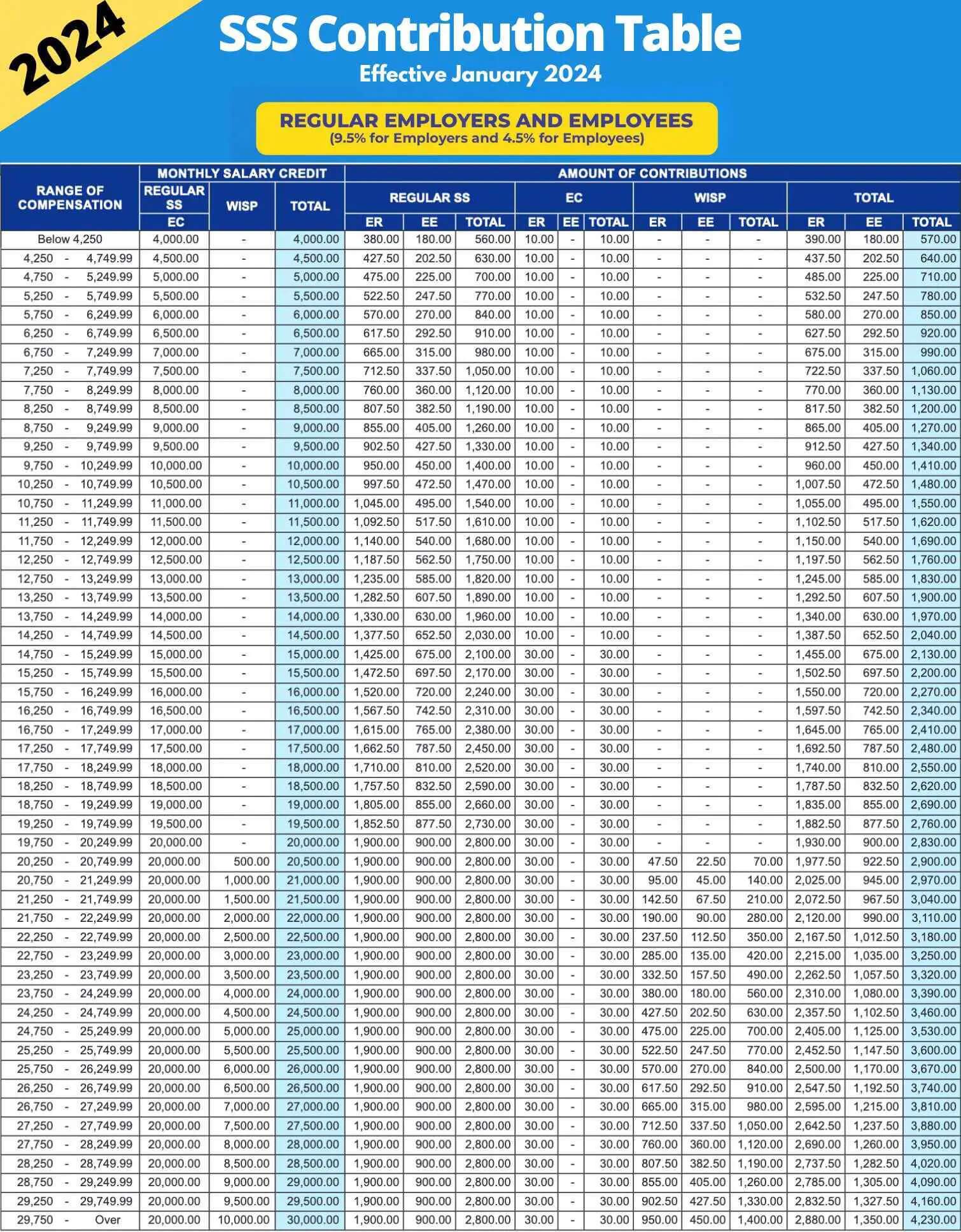

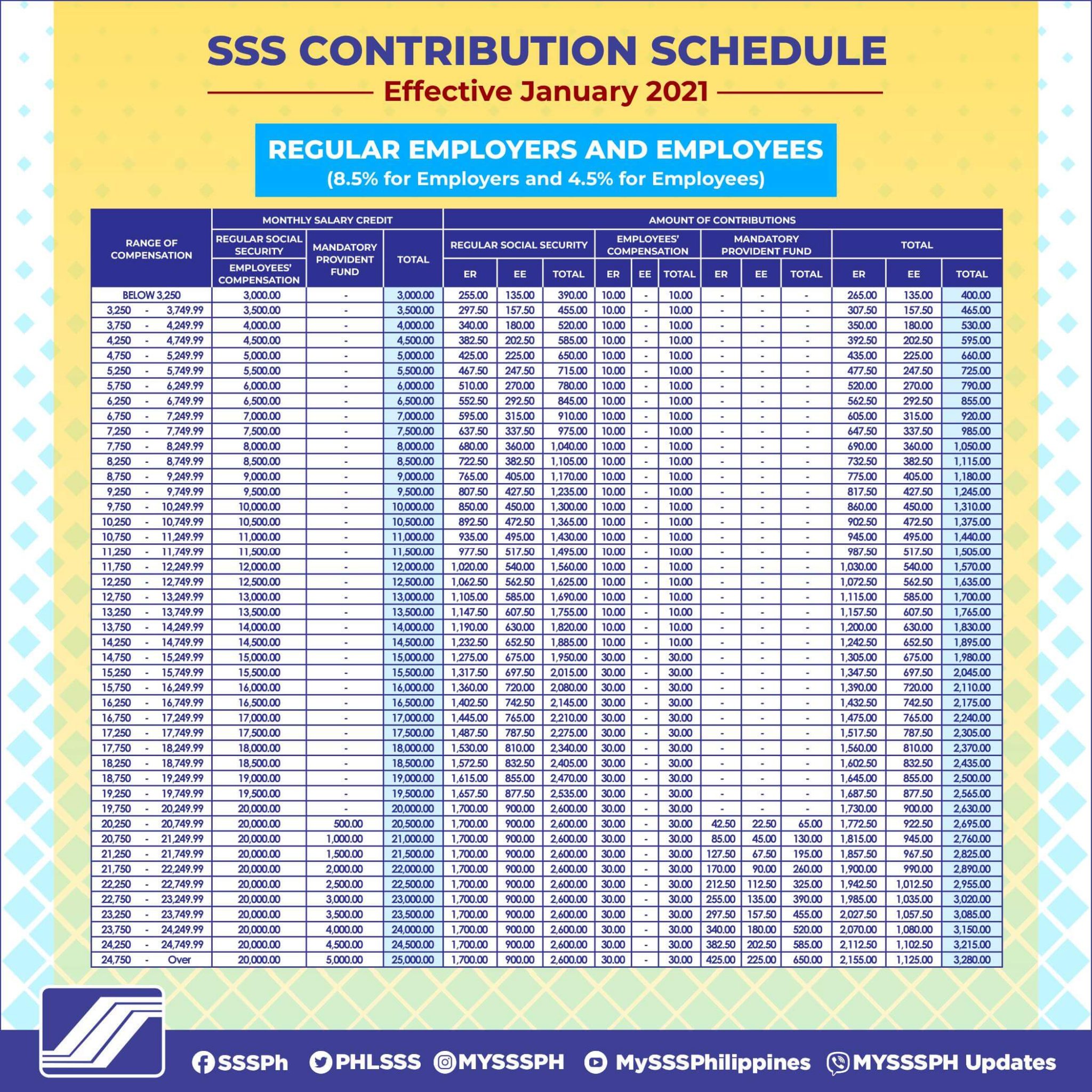

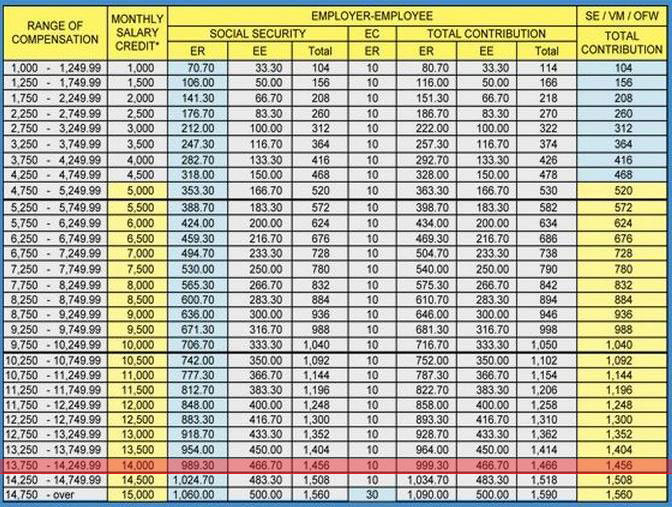

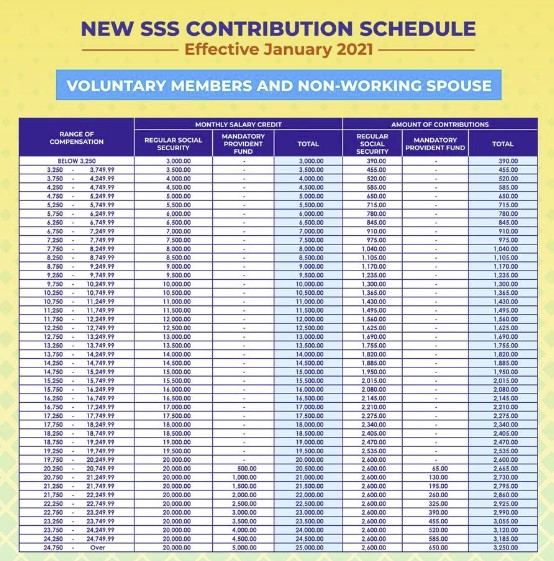

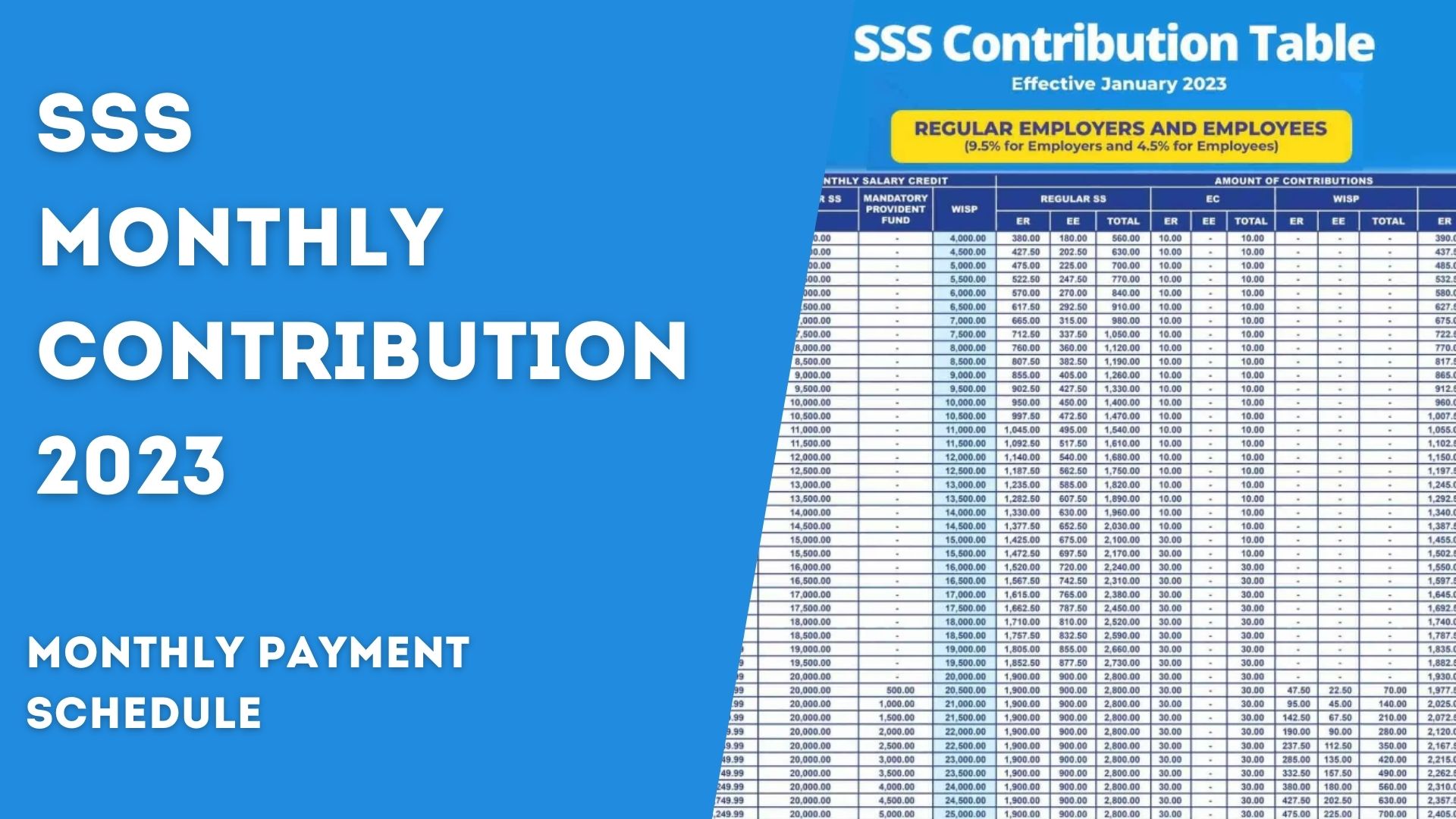

SSS Monthly Contribution Table Guide in the Philippines Digido, 56 rows these are the notable changes on 2025 sss contributions: If there are any changes to these rates, we will be update them here to keep you in.

SSS releases contribution table for OFWs; P2,400 premium payment takes, Sss benefits and qualification requirements. Here are the 5 lastest sss contribution tables for 2025 that you can use to calculate your contribution:

SSS Contribution Table 2025 What's New? Para sa Pinoy, How much is sss sickness. You can find the pension factor in the sss table of pension factors, which is available on the sss website or at any sss office.

SSS Monthly Contribution Table Guide in the Philippines Digido, The sss contribution rate is based on the monthly salary credit of the member and ranges from 11% to 14%, with a maximum monthly contribution of php 1,760.00 for 2025. Sss benefits and qualification requirements.

What’s New SSS Contribution Table 2025 QNE Software, For comments, concerns and inquiries contact: Sss benefits and qualification requirements.

SSS Contribution Table and Deadline of Payments Business Tips Philippines, The sss contribution rate is based on the monthly salary credit of the member and ranges from 11% to 14%, with a maximum monthly contribution of php 1,760.00 for 2025. How much is sss sickness.

SSS Monthly Contribution Table Guide in the Philippines Digido, 56 rows these are the notable changes on 2025 sss contributions: Here are the 5 lastest sss contribution tables for 2025 that you can use to calculate your contribution:

SSS Monthly Contribution Table Guide in the Philippines Digido, Below, we outline the current effective contribution rate tables from the sss. Historically, the sss set deadlines for contributions based on the last digit of the employer’s or individual member’s sss number.

thenewssscontributionschedule by SSS Philippines via Slideshare, Sss benefits and qualification requirements. Sample computation for sss retirement.

SSS Contribution Table for 2025 Triple i Consulting Inc., Sss contribution employees and employers table 2025. This is the maximum cap of your salary, if it's more than this, your contribution will just be based on this maximum range.

The sss contribution rate is based on the monthly salary credit of the member and ranges from 11% to 14%, with a maximum monthly contribution of php 1,760.00 for 2025.

Proudly powered by WordPress | Theme: Appointment Blue by Webriti