Capital Gains Tax Uk 2025

Capital Gains Tax Uk 2025. This is down from £6,000 in the 2025/24 tax year. Use our capital gains tax (cgt) calculator to work out how much tax you might have to pay.

For the tax year 2025 to 2025 the aea will be £6,000 for individuals and personal representatives, and £3,000 for most trustees. The chancellor of the exchequer has made several announcements concerning rates and allowances applying from 6 april 2025, including the continued freezing of several key.

Uk Capital Gains Tax Rates 2025 2025 Elga Nickie, Capital gains taxes are paid on profits generated from asset sales or transfers in the uk once the annual allowance is exceeded.

Uk Capital Gains Tax Rates 2025 2025 Cyndi Dorelle, What capital gains tax (cgt) is, how to work it out, current cgt rates and how to pay.

Uk Capital Gains Tax Rates 2025 2025 Elga Nickie, The uk budget 2025's capital gains tax reforms represent a significant shift in the government's approach to the property market and housing policy.

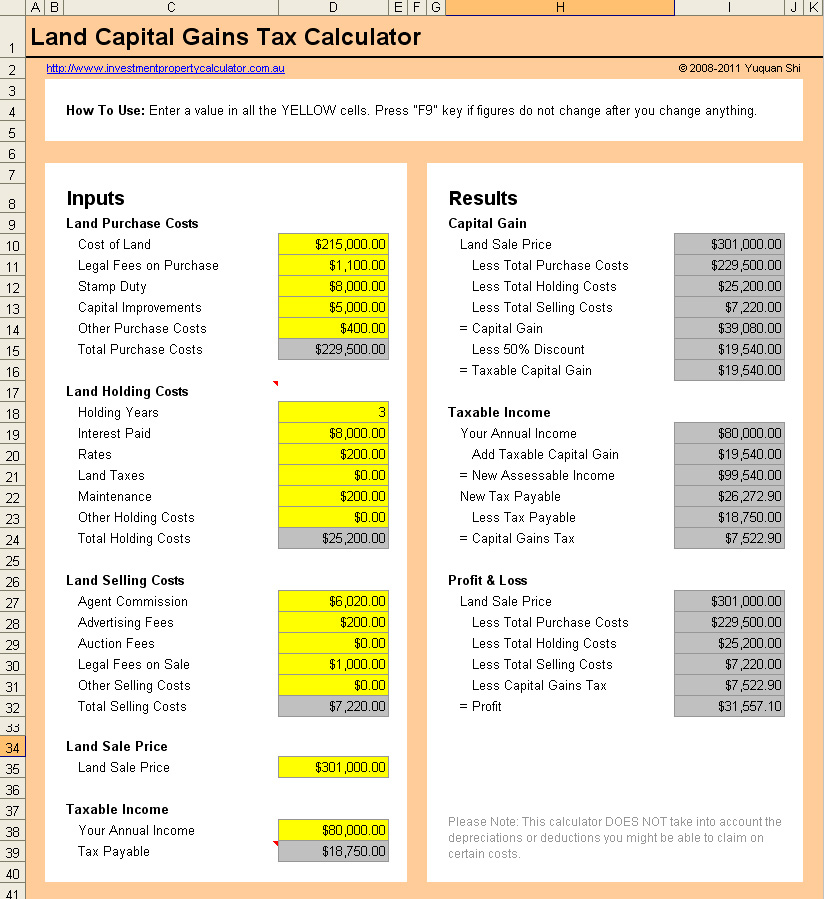

Capital Gains Tax Calculator 2025 Uk Kial Selina, The uk budget 2025's capital gains tax reforms represent a significant shift in the government's approach to the property market and housing policy.

Capital Gains Tax 2025/25 Uk Ira Meghan, Quickly know how much capital gains tax you owe on your profits from property, shares, crypto and more.

Capital Gains Tax 2025/2025 Uk Ines Paulita, Quickly know how much capital gains tax you owe on your profits from property, shares, crypto and more.

Capital Gains Tax 2025 25 Sally Consuelo, The government has previously announced that the cgt annual exempt amount will reduce from £6,000 to £3,000 from april 2025.

Capital Gains Tax 2025 Uk Adel Loella, This measure changes the capital gains tax (cgt) annual exempt amount (aea).

2025 Capital Gains Tax Rate Calculator Etty Sallyanne, This is down from £6,000 in the 2025/24 tax year.

Uk Capital Gains Tax Threshold 2025/25 Dorey, You'll only pay cgt on the gain you make from an asset, rather than the.