2025 Tax Brackets Married Jointly Single

2025 Tax Brackets: Married Jointly Single. Based on your annual taxable income and filing status, your tax. 10%, 12%, 22%, 24%, 32%, 35% and.

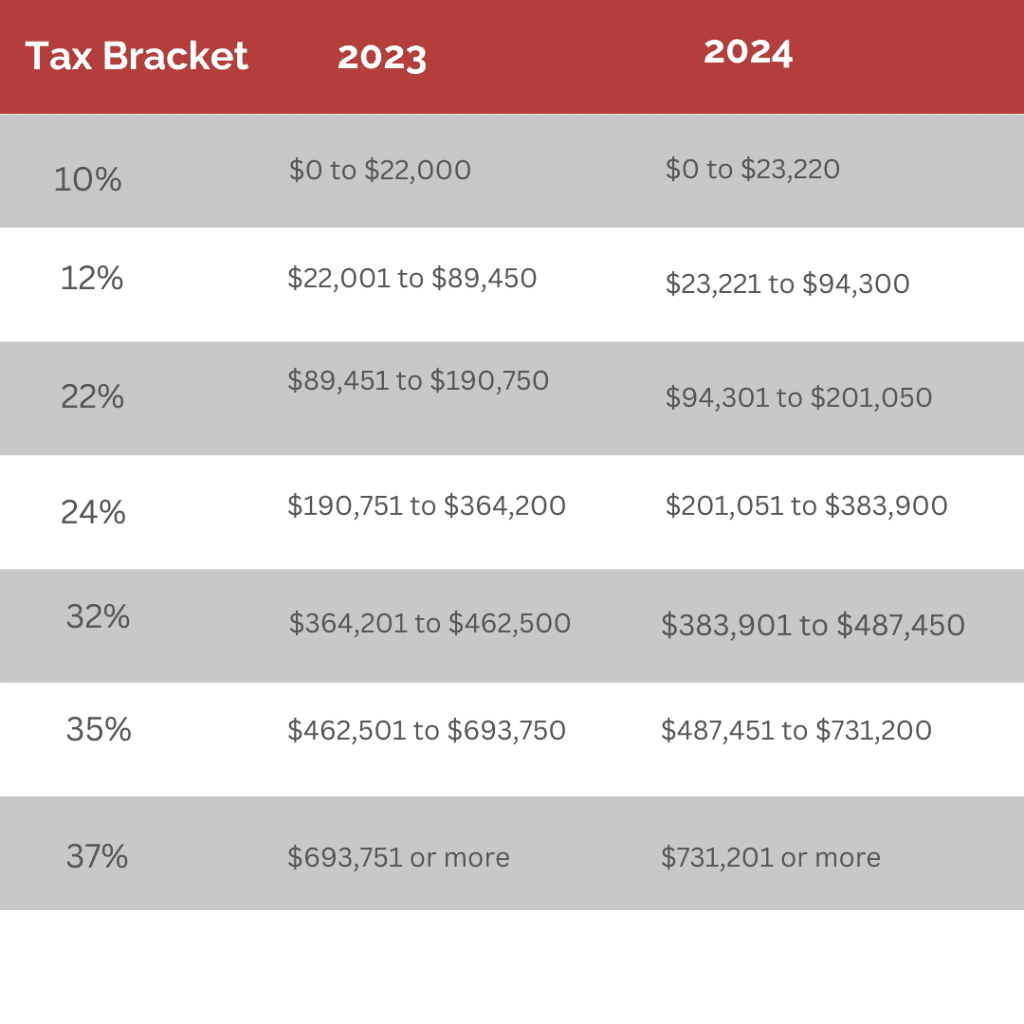

Your bracket depends on your taxable income and filing status. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Standard Tax Deduction Married Jointly Single Kial Selina, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Tax Brackets Married Jointly Vs Separately Korry Mildrid, Single, married filing jointly or qualifying widow (er), married filing separately and head of household.

Tax Brackets 2025 Married Jointly Irs Deeyn Evelina, The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold.

2025 Tax Brackets Married Filing Jointly Irs Vivi Yevette, Single, married filing jointly, married filing separately, or head of household.

2025 Tax Brackets Married Jointly Single Amata Bethina, Single, married filing jointly, married filing separately, or head of household.

Irs 2025 Tax Tables Married Jointly Zarla Maureen, In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year.

Tax Bracket For 2025 Married Filing Jointly Lizzy Camilla, Your bracket depends on your taxable income and filing status.

IRS Announces 2025 Tax Brackets. Where Do You Fall? Recent, The change will raise the top tax rate of 37% to $609,350 for individuals and $731,200 for married couples filing jointly—up from the current tax season’s threshold.

Tax Bracket Changes 2025 For Single, Household, Married Filling, While the tax rates are identical for 2025 and 2025, the irs increased the income thresholds that determine your bracket by about 5.4% for 2025.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, To figure out your tax bracket, first look at the rates for the filing status you plan to use: